There have been a few excellent articles and studies on provider consolidation – and how much this impacts the overall costs of health care costs.

Kaiser Health News and NPR aired a 7 minute piece on Saturday demonstrating the impact of Sutter Health System in northern California

Click to enlarge image

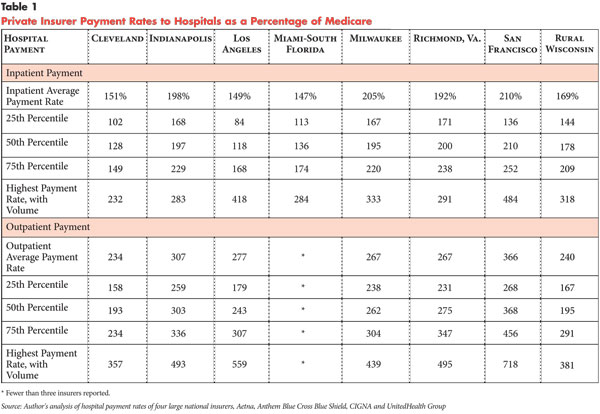

The Center for the Study of Health System Change published a study of 8 markets (including northern and southern California Los Angeles

The Boston Globe noted last week that Massachusetts Attorney General Martha Coakley has promised to revisit the issue of provider market clout, worrying that proposed payment reform is not enough. However, as the Center for Health System Change noted, once there are widely different allowed charges among facilities, it will be very hard indeed to roll these back.

The New York Times published an article today noting increasing consolidation of hospitals, ambulatory care centers and physicians. The article outlines the fear that as providers establish accountable care organizations to service Medicare under health care reform, their influence will grow even larger, as will their ability to extract high prices.

Click to enlarge image

OK – that’s the doom and gloom. In our class last week, we saw a graphic showing that hospitals have MUCH less consolidation (at least according the US

Wrong!

Health care delivery is hyperlocal. Sutter has very high prices and very high margins, and Sutter has high market penetration and importance in its limited geography. It doesn't matter that Sutter provides under 1% of all health care delivery in the US, while United HealthCare is responsible for insuring 70 million Americans. In Northern California, Sutter has far greater dominance than any health plan, and is able to use that to drive very high prices. Limited or tiered networks can exert at least some downward pressure on these prices.