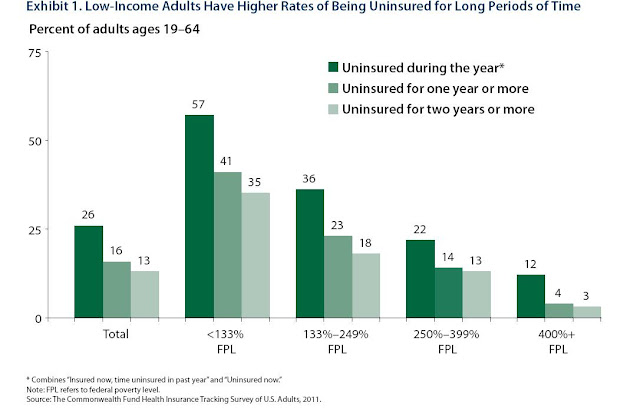

Today’s Managing Health Care Costs Indicator is 35%

|

| Click on image to enlarge. Source |

Yesterday, I told two stories demonstrating the danger the current health care financing system poses to those with serious chronic illnesses – threatening them with loss of coverage and

The Commonwealth Fund published its tracking survey yesterday, which demonstrated that the economically disadvantaged face the same type of challenges in obtaining coverage and care. Adults who are poor (<133% of federal poverty level) are much more likely to be uninsured. The likelihood of being uninsured for the entire previous two years was 35% among those at <133%FPL, compared to only 3% of those with income >400%FPL. Overall likelihood of being uninsured for some time over the previous two years was 26% for the entire sample – but this ranged from 57% (<133% FPL to 12% (>400% FPL). The study included over 2100 respondents, and was adjusted to be a nationally representative sample.

The Commonwealth Fund study also noted:

· 28% of all respondents were seen in an Emergency Department over the last year. Those who were uninsured during the year were more likely to report going to the ED because they needed a prescription (50% vs. 35%), because they did not have a regular physician (41% vs. 16%), and because they believed that other sites of care cost too much (40% vs. 20%)

· Those who were uninsured during the year were five times less likely to have colon cancer screening (10% vs. 50%). They were twice as likely not to receive a mammogram (32% vs. 66%)

· Those who were uninsured said they skipped colon cancer screening because it was too expensive six times more frequently than those who maintained insurance all year. (33% vs. 5%)

· Almost 2/3 of those with income <133% FPL depended on Medicaid or SCHIP to obtain health coverage (63%), but they were still most likely to have at least one child uninsured (31%, compared to 19% overall)

Income insecurity has gone up dramatically in the United States

The Commonwealth Study shows that health insecurity is a frequent complication of economic hardship. This leads to low value patterns of health care consumption, including unnecessary ED visits and foregone preventive care. The Affordable Care Act should reduce the coverage problem substantially starting in 2014, as the federal government provides premium support, and assuming the states establish exchanges to make it easy and (relatively) cheap to purchase health insurance. Lack of access to health insurance leads to poorer medical outcomes – including cancers unnecessarily diagnosed at a late stage. We need the Affordable Care Act and its provisions that will make it far easier for Americans to obtain health insurance coverage.